SPESENFUCHS

If you already have to travel on business, you shouldn’t miss the opportunity to save on taxes.

Why can you save taxes through business travel?

Legislation has established that under certain conditions you can receive money from your employer or pay yourself as a self-employed person, which are completely tax-free. So if you create a travel expense report instead of paying yourself these amounts as a salary, you save on taxes!

What are additional meal expenses?

Actually, the word says it all. When you travel on business, you usually have an extra expense for meals. The sandwich and coffee in the shop cost more than the sandwich and coffee at home. Therefore, the legislator says that these amounts, determined per day, period and country, are tax-free.

What are the options?

There are several ways to save on taxes by preparing travel expense reports.

Meal allowances are tax-free

As described in the introduction: flat rates apply to additional meal expenses, which are tax-free. The duration of the absence and the country to which travel was made are decisive for the amount of the lump sums. If I have to travel on business, I should therefore prepare a travel expense report for this trip, regardless of whether or not my employer (in the case of an employee) reimburses me for additional subsistence expenses.

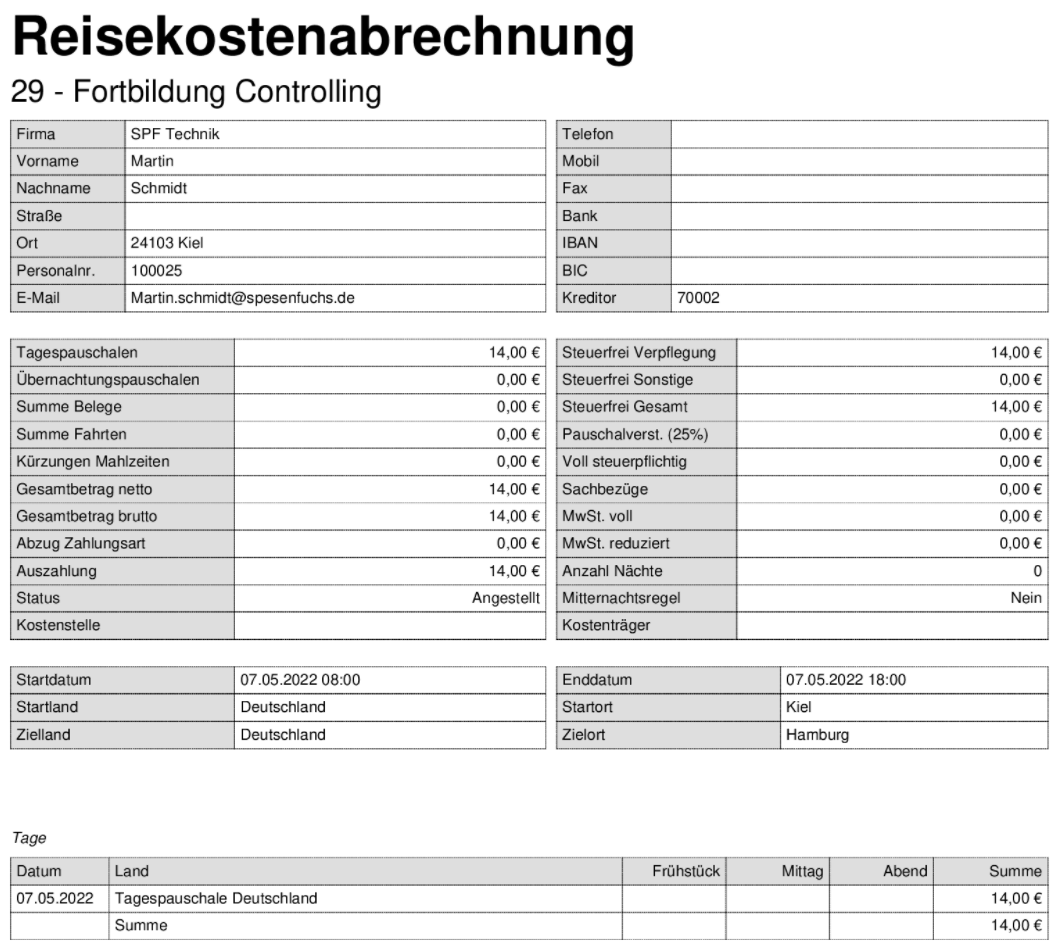

Example: A 1-day trip over 8 hours – 14 € tax-free

Mileage allowances are tax-free

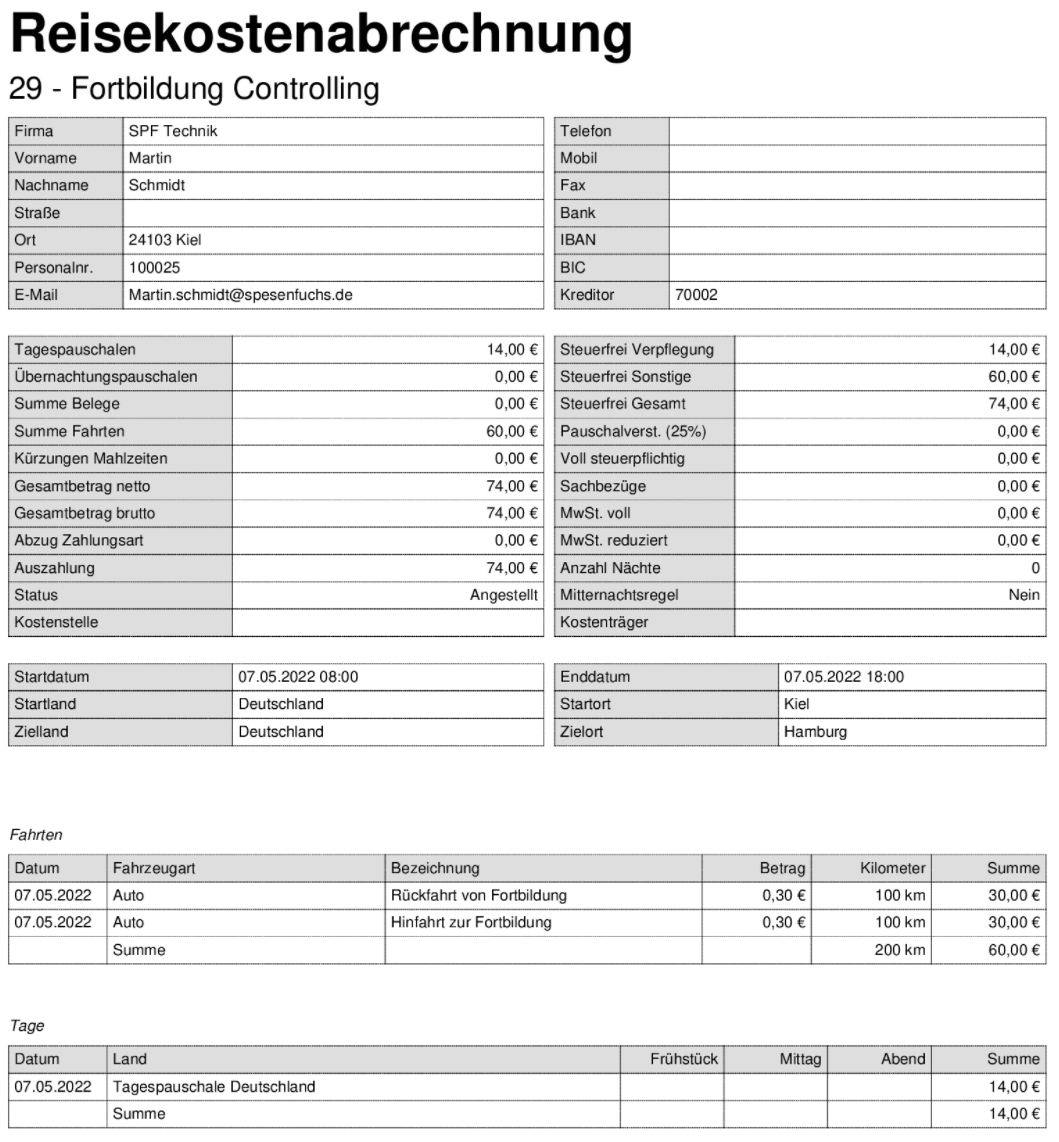

Kilometers driven by car or motorcycle in the course of a business trip with a private vehicle are also tax-exempt at the rate of €0.30 per kilometer or €0.20 in the case of a motorcycle.

There is another blog post on this topic: Difference between commuting allowance and mileage allowance

Example: 1-day trip over 8 hours – 14 € tax-free, 0,30 € tax-free reimbursement per kilometer

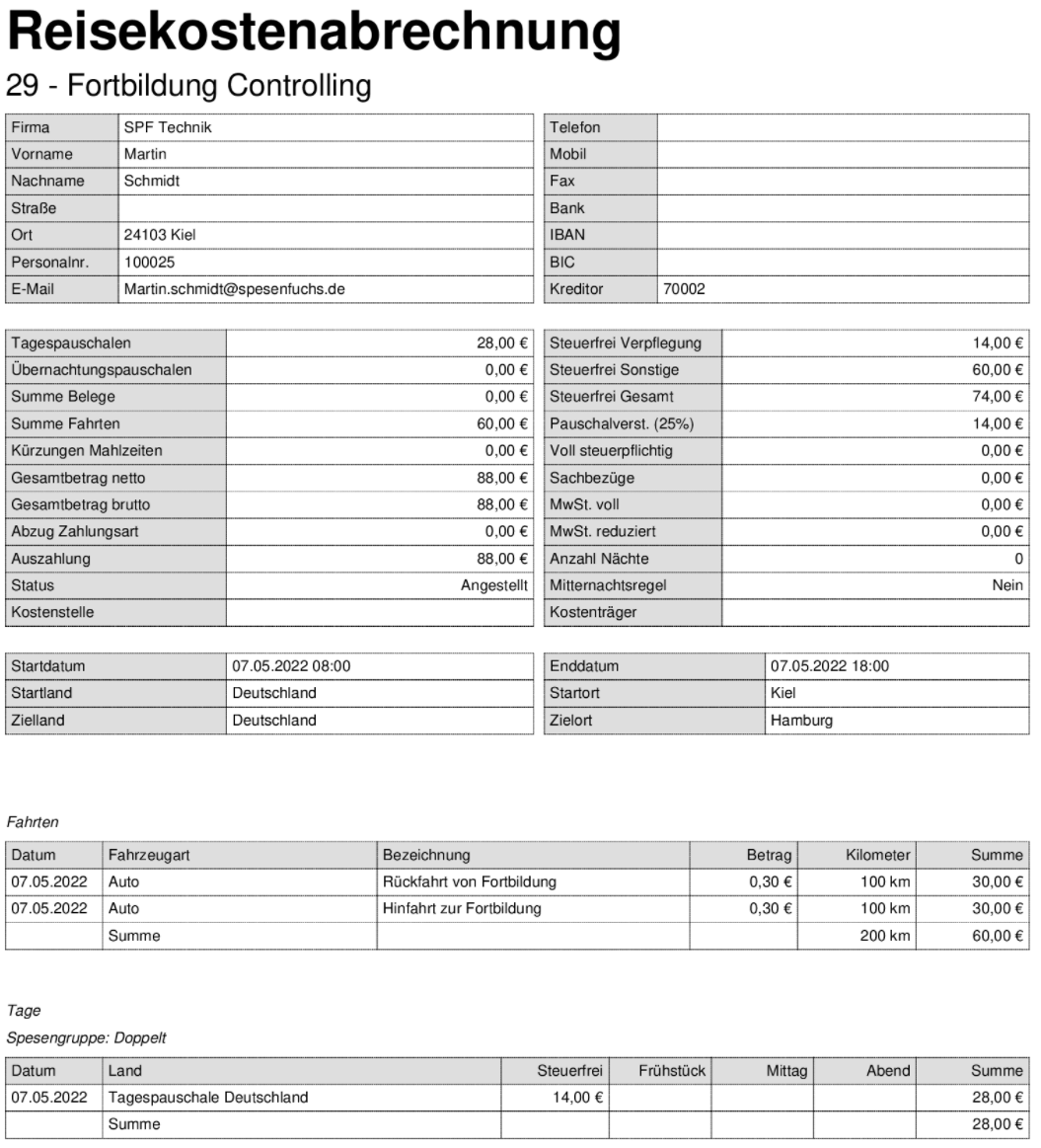

Double meal allowance

It is permissible to pay the same amount again in addition to the normal tax-free meal allowance, which the employer taxes at a flat rate of 25%, i.e. pays the tax. Because the employer pays a flat rate of tax, the additional amount does not have to be reported as taxable wages in the wage tax certificate or tax return. The lump-sum taxed amounts are exempt from social security contributions. Compared with taxable wages, not only do you save about 20% in social security contributions, but so does the employer.

Example: 1-day trip over 8 hours – 14 € tax-free, 14 € taxed at a flat rate

Total account

Saving taxes can be further optimized beyond the cases already discussed by a so-called “total account”. Here, the per diems for meals, per diems for overnight stays and travel expenses by car or motorcycle of a trip are added together. This is contrasted with the amount actually allowed by additional subsistence expenses and tax-free kilometers. That which exceeds this amount may be treated uniformly as additional subsistence expenses and, as we have seen above, can only be taxed at a flat rate of 25%, provided that the 100% limit is not exceeded. For example, it is possible to pay only kilometers but no additional subsistence expenses but still take advantage of the lump-sum taxation. Or, a mileage rate that exceeds the statutory tax-free amount of 30 cents/km may be subject only to the 25% flat tax.

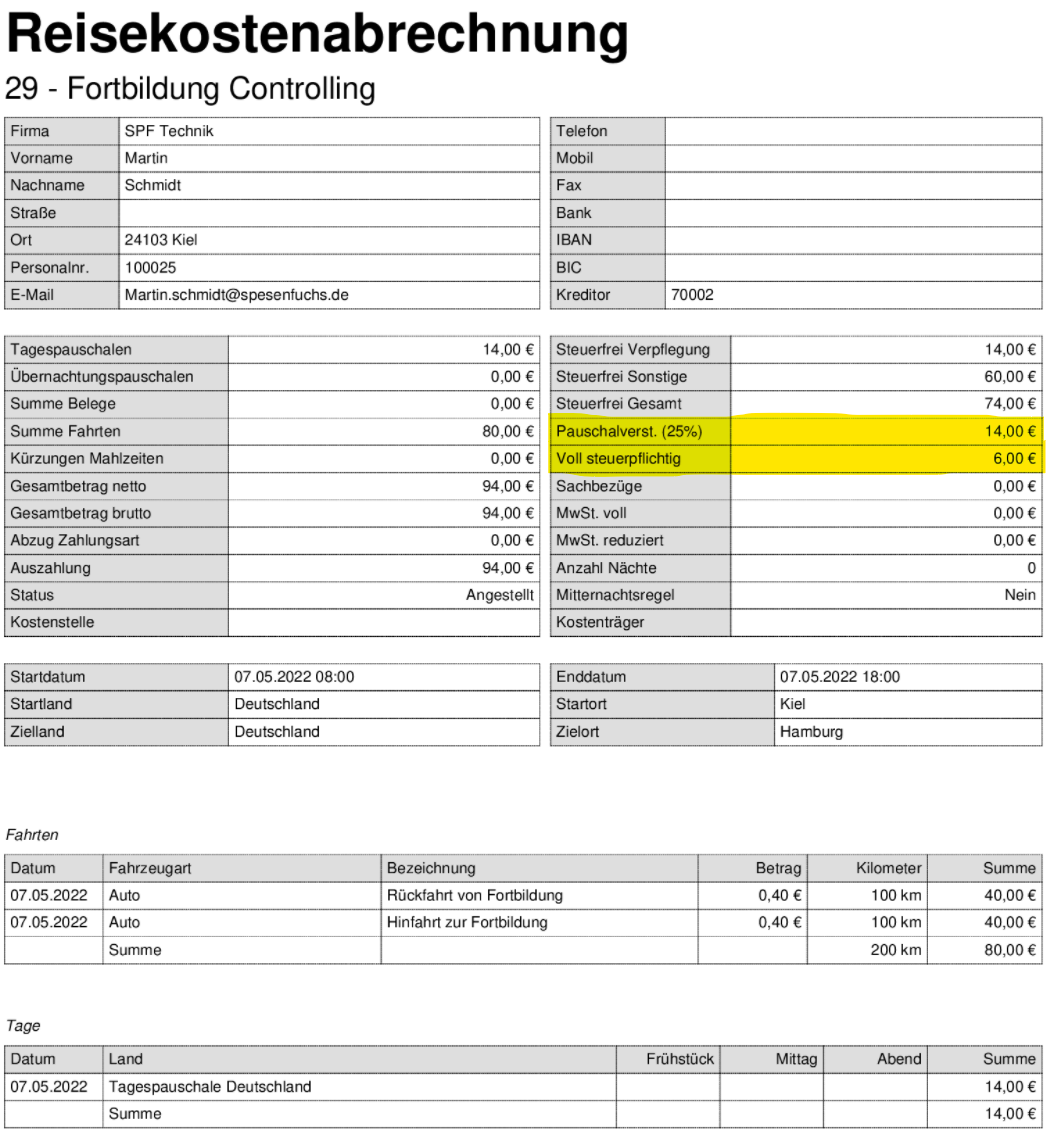

In the following two examples, the identical trip is accounted for. Once without the lump sum (total invoice) and once with lump sum.

The trip includes the statutory per diem for meals and €0.40 per reimbursement per kilometer.

In the first example, this means that the meals allowance and the mileage allowance are considered separately and thus the €0.10 additional mileage reimbursement paid must be fully taxed. In the underlying example, therefore, €20.00.

In the second example, the total calculation comes into play. This means that up to the amount of double the per diem meal allowance, only 25% must be taxed at a flat rate. So in this example 14 €. Remains € 6, which must be fully taxed.